- Successful return to high profitability – Towards mid-term goals· BRE Bank’s consolidated profit was PLN 337.9 million gross and PLN 247.5 million net in 2005

· The retail banking business broke even on an annual basis

· The new corporate banking strategy BREactivation was implemented successfully

· The year 2006 will further strengthen the Bank’s position on the way towards mid-term goals for 2007-2008

The BRE Bank Group closed the last quarter of 2005 with a success of structural business change. At the end of Q4 2005, BRE Bank generated a consolidated pre-tax profit of PLN 337.9 million, exceeding both the original (PLN 290 million gross) and the updated (PLN 330 million) financial target. The net profit was PLN 247.5 million, the highest in four years. After a period of weak performance in 2002—2004, the Bank restored its strong financial position and thus made a large step forward towards the ambitious mid-term goals which include a gross ROE of at least 20% in 2007. BRE Bank enters the new year – the year of its 20th anniversary – stronger with the structural adjustment of its corporate banking strategy and its dynamically growing retail banking business which broke even on an annual basis for the first time ever.2005: A Break-Through YearThe past year was a break-through period for BRE Bank. In early January 2005, BRE Bank had to regain the market’s trust in the Bank’s capacity for growth and thus its capacity of generating a high profitability. In this context, it was key to enhance the effectiveness of operations in all of the Bank’s businesses. The main challenges were tackled through the BREactivation strategy: the restructuring of the corporate banking model and on-going expansion in the retail banking market which enabled the business line to report its first-ever (annual) pre-tax profit. In 2005, the Bank continued with its model of risk mitigation and of sustaining the profitability of its investment banking business.“We will not limit out ambitions to the good results of 2005; this is only the beginning of what we can do. BRE Bank will establish stable performance enabling ROE of at least 20% gross. The Bank will face the financial challenge while always raising the quality of service, advisory, and state-of-the-art products offered to customers. The combination of these factors will be key to our market success, and the success will be in our reach if the company provides added value both to customers and the shareholders,” said Mr Sławomir Lachowski, CEO of BRE Bank.

Goals for 2006BRE Bank wants to live up to the ambitious challenges of the next 2—3 years, and so in 2006 it will continue the positive growth trends which began in 2005. The 2006 target is to achieve a significant growth in the pre-tax profit up to ca. PLN 380 million. BRE Bank will strive to achieve:- gross ROE of over 18%- cost/income ratio of ca. 66%- consolidated solvency ratio of ca. 10.4% at the end of 2006.

BREactivation: The Strength of Corporate BankingThe corporate banking line generated a pre-tax profit of PLN 175.0 million in 2005. BRE Bank’s corporate banking business made great progress in 2005 in the implementation of its BREactivation strategy (see Appendix 1 for details). BRE Bank’s corporate banking business recorded a significant growth in average monthly deposits and loans. Average corporate deposits were up PLN 4.4 billion (46%) year on year in December 2005. Average balance-sheet loans were up 2% year on year in December 2005, and up 11% compared to September 2005. In 2005, BRE Bank’s share in the corporate deposits market grew (to 9.2%) while its share in the corporate loans market remained stable at almost 6%. BRE Bank attracted 1,917 new corporate customers in 2005, including 530 in Q4 alone.

Retail Banking Grows Ahead of the Market

BRE Bank’s retail banking business generated its first-ever annual profit of PLN 19.1 million gross. mBank alone reported a pre-tax profit of PLN 28 million. The results of the entire retail banking line were lower due to the performance of MultiBank which is now gaining the critical mass and will turn profitable in 2006. BRE Bank had 1.3 million retail customers with 1.5 million active accounts and PLN 5.1 billion in deposits, which makes BRE Bank the fourth largest retail bank. Over the past year, deposits grew 37% (by PLN 1.4 billion) compared to market growth of 3.5%. In 2005, the Bank granted PLN 1.7 billion in retail loans (up 75%, compared to market growth of 23%), including a mortgage loans portfolio growing 79% (PLN 1.4 billion). At 30 September 2005, BRE Bank moved up to number four among providers of mortgage loans (annual sale). BRE Bank serves more than 143 thousand customers in the microenterprise sector, ranking second in this market. The Bank has ambitious targets for the future. BRE Bank plans to have 1.6 million retail clients by the end of 2006, and to grow its portfolio of loans (to PLN 6.5 billion, including PLN 5.1 billion of mortgage loans) and deposits (to PLN 6.7 billion). The Bank’s position in the retail banking market will be strengthened by new strategic projects launched in 2006. One project will implement a new service model for microenterprises, BRE Bank’s important customer group. Another strategic project will intensify sales of insurance products under a bancassurance scheme.

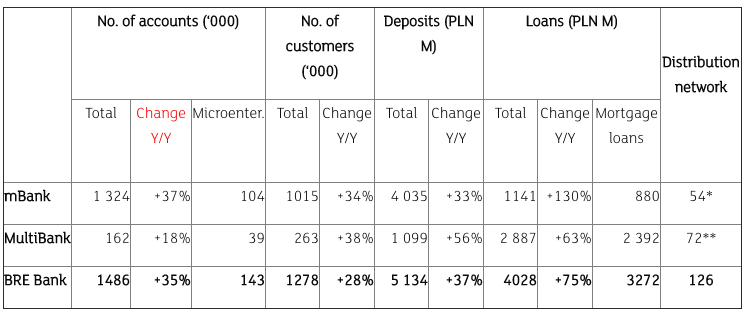

mBank and MultiBank Sales, 2005 year-end

· The retail banking business broke even on an annual basis

· The new corporate banking strategy BREactivation was implemented successfully

· The year 2006 will further strengthen the Bank’s position on the way towards mid-term goals for 2007-2008

The BRE Bank Group closed the last quarter of 2005 with a success of structural business change. At the end of Q4 2005, BRE Bank generated a consolidated pre-tax profit of PLN 337.9 million, exceeding both the original (PLN 290 million gross) and the updated (PLN 330 million) financial target. The net profit was PLN 247.5 million, the highest in four years. After a period of weak performance in 2002—2004, the Bank restored its strong financial position and thus made a large step forward towards the ambitious mid-term goals which include a gross ROE of at least 20% in 2007. BRE Bank enters the new year – the year of its 20th anniversary – stronger with the structural adjustment of its corporate banking strategy and its dynamically growing retail banking business which broke even on an annual basis for the first time ever.2005: A Break-Through YearThe past year was a break-through period for BRE Bank. In early January 2005, BRE Bank had to regain the market’s trust in the Bank’s capacity for growth and thus its capacity of generating a high profitability. In this context, it was key to enhance the effectiveness of operations in all of the Bank’s businesses. The main challenges were tackled through the BREactivation strategy: the restructuring of the corporate banking model and on-going expansion in the retail banking market which enabled the business line to report its first-ever (annual) pre-tax profit. In 2005, the Bank continued with its model of risk mitigation and of sustaining the profitability of its investment banking business.“We will not limit out ambitions to the good results of 2005; this is only the beginning of what we can do. BRE Bank will establish stable performance enabling ROE of at least 20% gross. The Bank will face the financial challenge while always raising the quality of service, advisory, and state-of-the-art products offered to customers. The combination of these factors will be key to our market success, and the success will be in our reach if the company provides added value both to customers and the shareholders,” said Mr Sławomir Lachowski, CEO of BRE Bank.

Goals for 2006BRE Bank wants to live up to the ambitious challenges of the next 2—3 years, and so in 2006 it will continue the positive growth trends which began in 2005. The 2006 target is to achieve a significant growth in the pre-tax profit up to ca. PLN 380 million. BRE Bank will strive to achieve:- gross ROE of over 18%- cost/income ratio of ca. 66%- consolidated solvency ratio of ca. 10.4% at the end of 2006.

BREactivation: The Strength of Corporate BankingThe corporate banking line generated a pre-tax profit of PLN 175.0 million in 2005. BRE Bank’s corporate banking business made great progress in 2005 in the implementation of its BREactivation strategy (see Appendix 1 for details). BRE Bank’s corporate banking business recorded a significant growth in average monthly deposits and loans. Average corporate deposits were up PLN 4.4 billion (46%) year on year in December 2005. Average balance-sheet loans were up 2% year on year in December 2005, and up 11% compared to September 2005. In 2005, BRE Bank’s share in the corporate deposits market grew (to 9.2%) while its share in the corporate loans market remained stable at almost 6%. BRE Bank attracted 1,917 new corporate customers in 2005, including 530 in Q4 alone.

Retail Banking Grows Ahead of the Market

BRE Bank’s retail banking business generated its first-ever annual profit of PLN 19.1 million gross. mBank alone reported a pre-tax profit of PLN 28 million. The results of the entire retail banking line were lower due to the performance of MultiBank which is now gaining the critical mass and will turn profitable in 2006. BRE Bank had 1.3 million retail customers with 1.5 million active accounts and PLN 5.1 billion in deposits, which makes BRE Bank the fourth largest retail bank. Over the past year, deposits grew 37% (by PLN 1.4 billion) compared to market growth of 3.5%. In 2005, the Bank granted PLN 1.7 billion in retail loans (up 75%, compared to market growth of 23%), including a mortgage loans portfolio growing 79% (PLN 1.4 billion). At 30 September 2005, BRE Bank moved up to number four among providers of mortgage loans (annual sale). BRE Bank serves more than 143 thousand customers in the microenterprise sector, ranking second in this market. The Bank has ambitious targets for the future. BRE Bank plans to have 1.6 million retail clients by the end of 2006, and to grow its portfolio of loans (to PLN 6.5 billion, including PLN 5.1 billion of mortgage loans) and deposits (to PLN 6.7 billion). The Bank’s position in the retail banking market will be strengthened by new strategic projects launched in 2006. One project will implement a new service model for microenterprises, BRE Bank’s important customer group. Another strategic project will intensify sales of insurance products under a bancassurance scheme.

mBank and MultiBank Sales, 2005 year-end

*14 Financial Centres + 40 mKiosks; **38 Financial Service Centres+ 34 Partner OutletsThe recent months saw the launch of emFinanse, a company which sells banking and insurance products. In the first year of its operation, the company will mainly distribute cash loans, car loans, and mortgage loans. Its 2006 targets provide for sales of loans worth several million zloties. The company plans to open several branches in nine of Poland’s largest cities by mid-2006. The long term target includes co-operation with up to 400 partner outlets all over Poland.In Q4, the private banking customers were mainly interested in investment funds. The investment products on offer now include new two-year guaranteed investment and insurance products in US$ and PLN. In response to demand from customers, subscriptions for five new structured products based on equities baskets and investment deposits were completed.

Investment Banking Strengthens the Position of the BankIn 2005, the investment banking line generated a pre-tax profit of PLN 199.2 million. The Bank continued to change the investment banking risk profile by focusing more on transactions ordered by customers. The Bank keeps its strong position in the market of non-Treasury debt. It is the leader among arrangers of bank bond issues (PLN 1.3 billion) and a top three arranger of corporate bond issues (PLN 1.1 billion) and short-term debt (PLN 1.2 billion). The Bank again won the status of Treasury securities dealer for 2006. In January 2006, the BRE Bank Group was awarded the Golden Bull in recognition of its highest share in option trading on the Warsaw Stock Exchange in 2005 (31.8%).

Strategic Subsidiaries: A Strong Asset of the BRE Bank GroupAll companies of the Group were profitable in 2005 and exceeded their financial targets. BRE Bank’s consolidated subsidiaries reported a total pre-tax profit of PLN 109.6 million (see Appendix 2 for details).

Key Performance IndicatorsAfter four quarters of 2005, the consolidated ROE was 17.8 gross (14.1% net). The strict cost regime continued: the cost/income ratio was 69.2% and is expected to fall in the coming years. The Bank’s solvency ratio grew considerably and was at a safe 12.9% (11.1% for the Group). The NPL ratio (according to the NBP rating) fell to 8.5% (from 12.4% in 2004). The Group’s total assets also grew significantly in 2005, by nearly PLN 2 billion, reaching PLN 33.1 billion.

Summary: 2005 Bodes Well for Future GrowthBRE Bank enters the new year – the year of its 20th anniversary – stronger with the success of the structural change completed in 2005. The Bank’s positive growth trends boosted its stock price on the Warsaw Stock Exchange. The stock price exceeded the historical maximum several times over the past few weeks (PLN 199 on 18 January 2006). The 2005 closing price was PLN 169, up 48% year on year, while the WIG20 index gained 35%. BRE Bank’s capitalisation was PLN 4.89 billion at the end of the year.“The year 2006 brings further ambitious challenges to improve last year’s profitability and effectiveness in order to ensure BRE Bank shareholders a gross ROE of at least 20 percent in 2007,” said Mr Sławomir Lachowski, BRE Bank’s CEO.BRE Bank’s growth will be driven by the structural changes in its corporate business strategy, including a growing share in the SME segment, and an improving position of the promising retail banking business. In this last segment, BRE Bank will focus on new projects implementing a bancassurance scheme and a new service model for microenterprises. Expansion in all these segments combined with a strong profitability of the investment banking business and growing results of the Group subsidiaries will provide an impetus for BRE Bank’s growth in 2006. The 2006 target is to achieve a significant growth in the pre-tax profit up to ca. PLN 380 million, and to maintain a high ROE of over 18% gross.

Investment Banking Strengthens the Position of the BankIn 2005, the investment banking line generated a pre-tax profit of PLN 199.2 million. The Bank continued to change the investment banking risk profile by focusing more on transactions ordered by customers. The Bank keeps its strong position in the market of non-Treasury debt. It is the leader among arrangers of bank bond issues (PLN 1.3 billion) and a top three arranger of corporate bond issues (PLN 1.1 billion) and short-term debt (PLN 1.2 billion). The Bank again won the status of Treasury securities dealer for 2006. In January 2006, the BRE Bank Group was awarded the Golden Bull in recognition of its highest share in option trading on the Warsaw Stock Exchange in 2005 (31.8%).

Strategic Subsidiaries: A Strong Asset of the BRE Bank GroupAll companies of the Group were profitable in 2005 and exceeded their financial targets. BRE Bank’s consolidated subsidiaries reported a total pre-tax profit of PLN 109.6 million (see Appendix 2 for details).

Key Performance IndicatorsAfter four quarters of 2005, the consolidated ROE was 17.8 gross (14.1% net). The strict cost regime continued: the cost/income ratio was 69.2% and is expected to fall in the coming years. The Bank’s solvency ratio grew considerably and was at a safe 12.9% (11.1% for the Group). The NPL ratio (according to the NBP rating) fell to 8.5% (from 12.4% in 2004). The Group’s total assets also grew significantly in 2005, by nearly PLN 2 billion, reaching PLN 33.1 billion.

Summary: 2005 Bodes Well for Future GrowthBRE Bank enters the new year – the year of its 20th anniversary – stronger with the success of the structural change completed in 2005. The Bank’s positive growth trends boosted its stock price on the Warsaw Stock Exchange. The stock price exceeded the historical maximum several times over the past few weeks (PLN 199 on 18 January 2006). The 2005 closing price was PLN 169, up 48% year on year, while the WIG20 index gained 35%. BRE Bank’s capitalisation was PLN 4.89 billion at the end of the year.“The year 2006 brings further ambitious challenges to improve last year’s profitability and effectiveness in order to ensure BRE Bank shareholders a gross ROE of at least 20 percent in 2007,” said Mr Sławomir Lachowski, BRE Bank’s CEO.BRE Bank’s growth will be driven by the structural changes in its corporate business strategy, including a growing share in the SME segment, and an improving position of the promising retail banking business. In this last segment, BRE Bank will focus on new projects implementing a bancassurance scheme and a new service model for microenterprises. Expansion in all these segments combined with a strong profitability of the investment banking business and growing results of the Group subsidiaries will provide an impetus for BRE Bank’s growth in 2006. The 2006 target is to achieve a significant growth in the pre-tax profit up to ca. PLN 380 million, and to maintain a high ROE of over 18% gross.